For me the reasoning's ridiculously simple, when judging their own fortunes they are close to the figures, they know their details, the issues that directly effect their company. For the wider economy however, they rely on the media which are much more likely to publish negative stories as this is more likely to sell papers and get people interested. As such they know the risks that directly effect their business and how to combat these, as well as what opportunities they can capitalise on.

I speak partially from experience. The company I work for is likely to have it's best year in 10 years for 2011 (figures to be finalised). It doesn't appear that 2012 will be quite as good, however the contracted work we have already locked in suggest no reason for alarm.

There are very logical reasons why people fear for the future of the Economy and why confidence here has decreased - mainly Europe. To be frank, when Greece were the problem there wasn't much of a problem, as Greece only accounts for under 2% of GDP of the 27 European countries (about 2.5% of Eurozone countries). Yes, the problems there were hard for the people there, however the wider impact should be limited. In fact, Greece, Ireland and Portugal combined account for under 5%. If you think of this as a single economy then this is totally manageable. However, in recent months we've seen the increased instability in the Italian economy - this accounts for a much bigger problem (around 13% or 17% respectively). It's no wonder that business leaders may think other companies could be effected by this, but many realise that this isn't a huge risk for their own company.

Most businesses are actually in good shape. Back in 2008/2009 many made redundancies as their profitability crashed (even though lots were still profitable), and since then rather than make investments they have retained cash within businesses. Over in America the non banks in the S&P 500 have over $2 TRILLION sitting in their banks, the highest ever level.

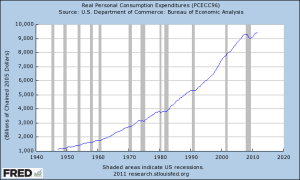

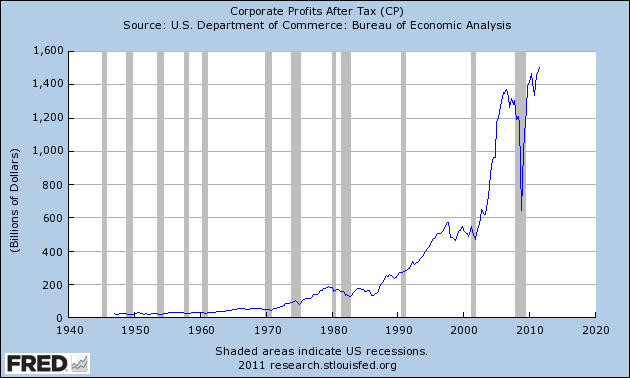

Keeping with America (I can't find details for UK/EU), corporate profits are at their highest ever level as is consumer spending. After all, although unemployment levels are far from ideal, these tend to be people who usually fill lower paying jobs.

Keeping with America (I can't find details for UK/EU), corporate profits are at their highest ever level as is consumer spending. After all, although unemployment levels are far from ideal, these tend to be people who usually fill lower paying jobs. Given that there are large numbers of unemployed it means that if a business is looking to recruit then there are large numbers of applicants for any position, meaning their wage demands aren't as high as they would have been had the crash not occurred, increasing the flexibility for a company.

Given what I've said above, I'm not worried at all about the US economy for 2012 and this tends to drive the global economy. The major worry for the UK is our proximity to the EU - Cameron's "bulldog" approach in December will do nothing to help this. If the European countries can keep themselves afloat then I see no reason for a business that is currently healthy to be worried about the future - although that's not what the media will tell you.

No comments:

Post a Comment